Address

555, North Point Center East, 4th Floor,

Alpharetta, GA 30022,

Adequate Wealth for Holistic Wellness

Unlock financial well-being and holistic wellness with our curated content and services. Explore authenticated resources tailored to empower you on the journey towards financial security and abundance, ensuring holistic wellness in every aspect of life.

Adequate Wealth for Holistic Wellness

Adequate wealth plays a crucial role in achieving holistic wellness by providing resources that support various aspects of life. Financial stability ensures access to healthcare, nutritious food, and a safe living environment, promoting physical well-being. Moreover, wealth enables individuals to pursue education, personal development, and leisure activities that contribute to mental and emotional health. Financial security reduces stress and anxiety, allowing for greater peace of mind and overall life satisfaction. Additionally, wealth affords opportunities for philanthropy and giving back to society, fostering a sense of purpose and connection. While wealth alone does not guarantee happiness, its prudent management and alignment with personal values can significantly enhance holistic wellness and quality of life.

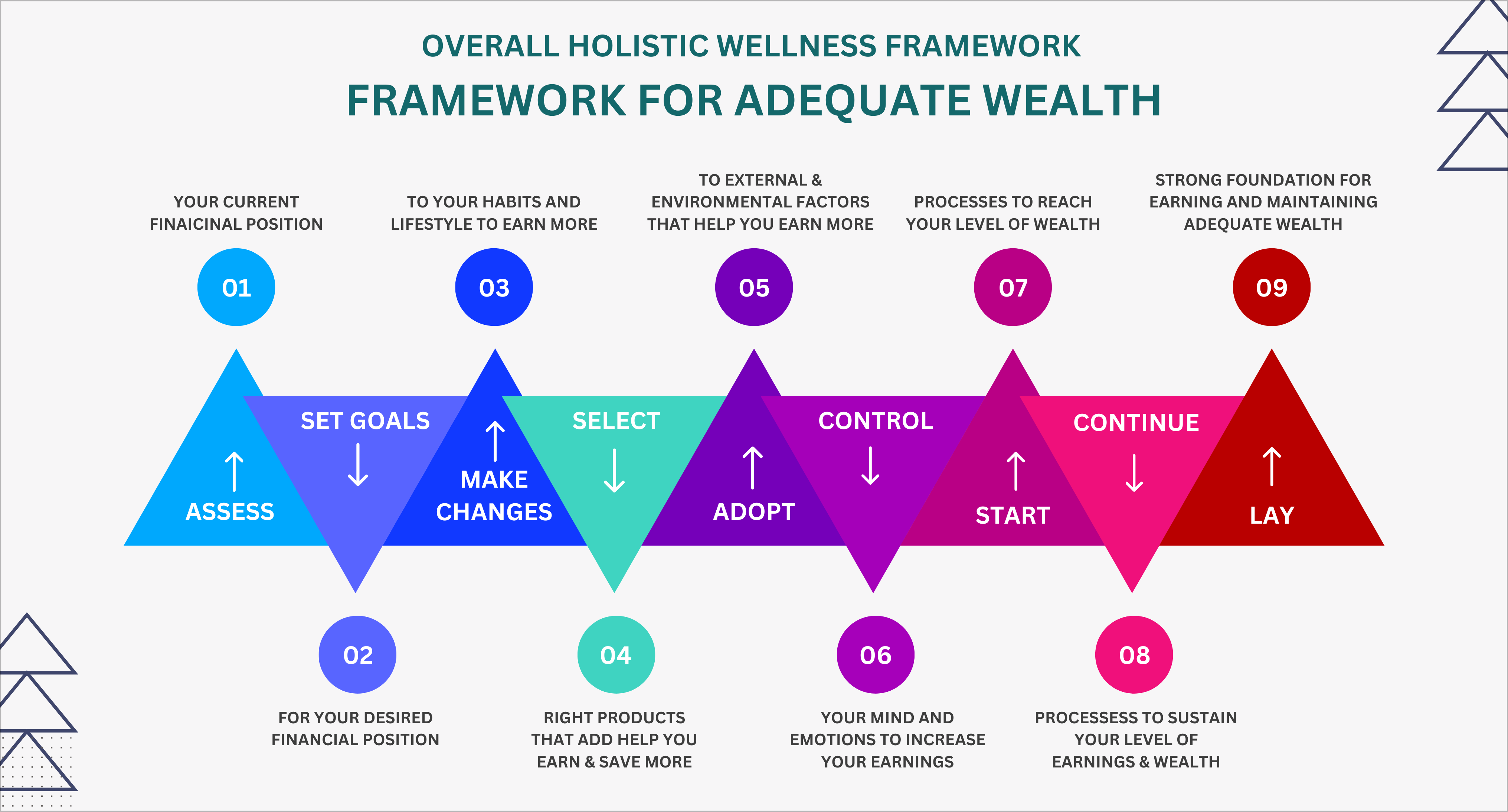

Four Components of your overall Holistic Wellness

The acquisition of adequate wealth comprises several essential components. Firstly, establishing clear financial goals and creating a detailed plan for achieving them is crucial. Secondly, adopting effective budgeting and saving strategies helps build a solid financial foundation. Thirdly, investing wisely and diversifying assets can facilitate wealth accumulation over time. Lastly, seeking opportunities for career advancement, entrepreneurship, or additional streams of income contributes to long-term financial prosperity and security. By integrating these components into their financial strategy, individuals can work towards acquiring adequate wealth to support their holistic wellness and life goals.

Financial Goals

Establishing clear objectives and crafting a strategic plan to achieve them is fundamental for acquiring adequate wealth.

Investment Strategy

Developing a well-thought-out investment strategy and diversifying assets can facilitate long-term growth and financial stability.

Budgeting and Saving

Effective management of finances through budgeting and disciplined saving habits is essential for wealth accumulation.

Income Growth

Seeking opportunities for career advancement, entrepreneurship, or additional sources of income is vital for enhancing wealth and financial security.

Financial Goal Setting for Adequate Wealth

Effective financial planning is instrumental in acquiring adequate wealth. It involves analyzing current financial status, setting realistic goals, and developing strategies to achieve them.

By creating a budget, managing expenses, and saving consistently, individuals can build a solid foundation for wealth accumulation. Moreover, financial planning encompasses investment management, risk assessment, and retirement planning, ensuring long-term financial security and prosperity.

With proper planning, individuals can navigate economic challenges, seize opportunities, and work towards achieving their financial aspirations for a secure and prosperous future.

Clarity

Define specific and measurable financial objectives to provide direction and focus for wealth accumulation efforts.

Prioritization

Determine the most important financial goals to allocate resources and efforts efficiently for optimal outcomes.

Realism

Set achievable goals that align with current financial circumstances and timelines for effective progress tracking.

Flexibility

Adapt goals as needed to accommodate changes in life circumstances, market conditions, and personal priorities for continued progress.

Budgeting and Saving Strategies

Budgeting and saving are fundamental for acquiring adequate wealth. By creating a budget, individuals can track income and expenses, identify areas for saving, and allocate resources effectively.

Consistent saving allows for the accumulation of funds over time, which can be invested wisely to generate additional income and grow wealth. Moreover, saving provides a financial safety net for emergencies and unexpected expenses, ensuring stability and security on the path toward long-term financial prosperity.

Expense Tracking

Monitor spending habits to identify areas for saving and ensure alignment with financial goals and priorities.

Consistent Saving

Allocate a portion of income regularly towards savings to accumulate funds for future goals and emergencies.

Budget Creation

Develop a comprehensive budget outlining income, expenses, and savings goals to manage finances effectively.

Financial Discipline

Practice restraint and avoid unnecessary expenses, prioritizing long-term financial security and wealth accumulation through disciplined saving habits.

Investment Strategies for Adequate Wealth

Implementing sound investment strategies is instrumental in acquiring adequate wealth. By diversifying investment portfolios and conducting thorough research, individuals can mitigate risks and maximize returns.

Whether through stocks, bonds, real estate, or retirement accounts, strategic investments can generate passive income and facilitate wealth accumulation over time.

Moreover, seeking professional advice and staying informed about market trends can help individuals make informed investment decisions, ensuring long-term financial growth and prosperity.

Goal Alignment

Select investments that align with your financial objectives, risk tolerance, and time horizon for optimal wealth accumulation.

Research and Analysis

Conduct thorough research and analysis to evaluate investment options and make informed decisions based on market trends and performance.

Diversification

Spread investments across various asset classes to minimize risk and maximize potential returns over the long term.

Regular Review

Monitor investments regularly and adjust strategies as needed to adapt to changing market conditions and align with financial goals.

Income Growth Strategies for Adequate Wealth

Employing income growth strategies is pivotal in acquiring adequate wealth. This involves enhancing earning potential through career advancement, skill development, or exploring additional income streams such as investments, side businesses, or passive income sources.

By maximizing income avenues, individuals can increase their capacity to save, invest, and accumulate wealth over time. Additionally, seeking opportunities for salary negotiations, promotions, or entrepreneurial endeavors can further bolster income growth, facilitating progress towards long-term financial prosperity and security.

Skill Development

Enhance qualifications and expertise through continuous learning and professional development to increase earning potential and career opportunities.

Diversification

Explore additional income streams such as investments, freelance work, or passive income sources to supplement primary earnings and boost overall income.

Career Advancement

Pursue opportunities for promotions, raises, or job transitions to secure higher-paying positions and accelerate income growth.

Entrepreneurship

Start a business or venture into entrepreneurship to leverage creativity and innovation for generating substantial income and wealth accumulation.

WE BELIEVE EVERYONE DESERVES TO LIVE A LIFE OF VITALITY PURPOSE & ABUNDANCE

Join us as we embark on a transformative journey towards holistic well-being, one pillar at a time. Begin your journey today and unlock the limitless potential within you.

OUR WELLNESS BLOG

Welcome to the KSOM Holistic Wellness Blog, your go-to resource for valuable insights and guidance on achieving holistic wellness. Explore a diverse range of topics through our informative blog posts, engaging videos, enlightening podcasts, and insightful infographics.

Whether you’re seeking advice on nutrition, mindfulness techniques, fitness tips, or holistic lifestyle practices, our content is here to support and inspire you on your journey towards optimal well-being. Dive into our wealth of resources and empower yourself to cultivate a life of balance, vitality, and fulfillment.